Common IRA You at the moment are permitted to contribute to a standard IRA in spite of your age. Under past legislation, you might no longer lead to a standard IRA when you finally turned 70½.

Early tax refund deposit relates to federal tax returns submitted specifically with The inner Income Services (IRS) and depends on IRS timing, payment Recommendations and lender fraud avoidance steps.

Cash continued to history right up until Soon before his death. "When June died, it tore him up", Rick Rubin recalled. "He stated to me, 'You will need to continue to keep me Operating mainly because I'll die if I don't have a thing to complete.' He was in a wheelchair by then and we set him up at his residence in Virginia… I couldn't listen to These recordings for two a long time right after he died and it had been heartbreaking when he died.

There’s also generally a penalty if you might want to withdraw the money prior to the fixed expression is in excess of. CDs aren't meant for people who want to obtain usage of their money. Fundamentally, you'll be able to withdraw the money you set in along with the curiosity it acquired only following the CD has matured.

As soon as you post your application, the workforce at 73 Cash will overview it and make a decision on the mortgage ask for. If permitted, you are able to acquire your cash in as small as 24 hrs, making it possible for you to rapidly address your economical demands.

When you are nearing the age to get RMDs and wish to avoid the extra profits and its tax implications, There is certainly Excellent news: A few approaches exist to Restrict and even eliminate the prerequisite. Underneath, we'll Have a look at 4 strategies to handle RMDs whenever you don’t want the money.

Opportunity challenges: Desire fees may well vary based on the lender you choose. Although this revenue continues to be available when you have to have it, you may be matter to penalties for withdrawing it or building various transactions.

Rapidly Financial loan Immediate advises borrowers to grasp own financial loans, warning that implementing for the utmost volume can raise repayment burdens. The corporation suggests assessing repayment capacity and loan requirement to harmony rapid desires with extensive-phrase pitfalls, selling accountable borrowing.

You will find tax factors in making lots of sorts of Roth conversions, so research the implications very carefully that has a tax advisor. When you have dollars inside a Roth IRA, however, there aren't any RMDs inside your or your partner’s lifetimes.

If your bus halt features a shelter, your probabilities of viewing the listing of bus routes passing by tend to be higher. But it surely even now is often incomplete or out-of-date.

Why devote: For individuals who appreciate aquiring a protection blanket more than their investments, dividend-spending stocks could be an alternative. Businesses can pay a decent volume of dividends that produce a far more dependable stream of cash flow for seniors.

This is necessary of each lender under the Truth of the matter in Lending Act. If you comply with the charges and charges, the lender will immediate you to an e-signature webpage, and also your loan might be processed.

Quite a few retirees opt to hold off on using their to start with RMD because they figure They are going to be in a very reduced tax bracket after they retire. Although Keeping off is smart for many, Additionally, it usually means you will have to acquire two distributions in one calendar year, which results in extra profits the click here IRS will tax. This could also press you back again into a better tax bracket, making an even greater tax function.

For those who have come to be informed that A child of which you're a dad or mum or guardian of has produced obtainable personal facts by using our point of Get hold of then we urge you to Make contact with us straight away to ensure that we could delete this information from our information.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Tiffany Trump Then & Now!

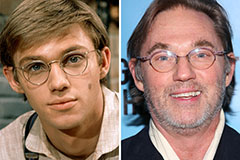

Tiffany Trump Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lisa Whelchel Then & Now!

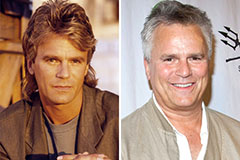

Lisa Whelchel Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!